Why A Recession May Be the Best Opportunity to Invest in Real Estate

A downturn in the economy doesn't have to mean a downturn in your real estate investing plans. In fact, recessions can actually provide some of the best opportunities for savvy investors who know where to look and what to look for.

What Is A Recession?

With inflation on the rise and general fear across the nation, many believe the country is headed into a recession. By definition, a recession is a temporary economic decline that lasts for more than two consecutive quarters.

Although we have already experienced two consecutive quarters of economic decline, there is no reason to run for the trenches just yet - if at all. Besides the one defining metric for a recession, there are other economic metrics that are positive. Unemployment remains steady, company revenues in many industries are up and consumer spending hasn't strayed from normal.

Recession can be an intimidating word to most and strike fear and cause to batten down the hatches and prepare for the worst. However, doing so may cause you to miss out on some of the best opportunities to set yourself up to succeed in the future. It is best to keep a level head and even consider investing during a recession because it often presents a price correction across the spectrum and allows you to invest at a lower price.

What Happens To Property During A Recession?

Economic recessions - and the following response from the Federal Reserve - will generally affect the housing market.

Currently, we are seeing rapidly rising interest rates to correct for the rapid inflation caused over the last few years. This is causing demand for homes to fall since prices are high and now, with higher interest rates, it is getting increasingly harder to buy your dream house.

With demand falling and people generally not willing to spend as much when getting into a new home - fewer people are competing for the same inventory of homes. We are no longer seeing bidding wars on properties that have been listed for 1 day and go for 5-10% above listing price - phew! When that competition dries up, prices generally start to see correction to the downside.

While this is bad news for sellers (as they will likely have to settle for less than their initial asking price), it can be good news for buyers or investors that were hoping for a less competitive market.

Should I Invest During A Recession?

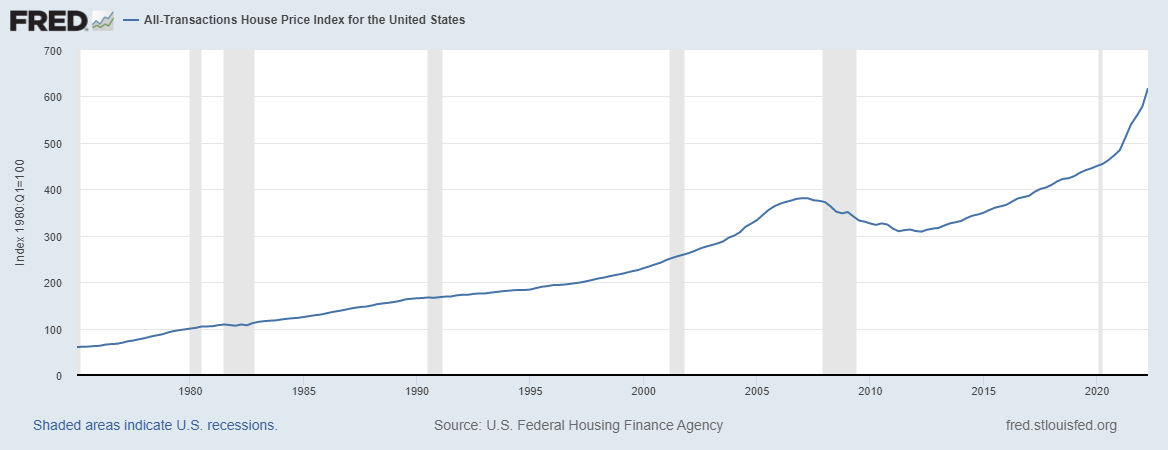

When looking to invest in real estate during a period of economic uncertainty, it is important to remember that real estate is generally a long term investment. If you keep that in mind along with the fact that housing prices generally trend more up than down, you can have an open mind to the opportunities that a market correction creates.

It has been said that bear markets and recessions create some of the largest transfers of wealth from investors who sell out of fear and those who are buying the dip.

Dollar cost averaging is an investing concept used by investors large and small to increase their profit potential by lowering their average cost of investment. Now, it is impossible for anyone to time the dip of the market perfectly and more than likely you won't find the perfect time to invest when prices are at all time low and interest rates are dropping rapidly.

Instead of trying to time the impossible, you can use dollar cost averaging to your advantage. If you start investing on the way down, you can lower your average with each investment you make - increasing the overall value of your investment once the market inevitably rebounds overtime.

If you want to take advantage of this recession but don't know where to start - check out our other articles to learn more about real estate investing.

If you are actively looking to find your next investment property, check out our Top Property List - where we analyze top markets and curate a list of the top properties with investment opportunity.

If you prefer a more hands off approach to investing but are itching to add real estate investments to your portfolio, consider becoming a HomeStakes investor to see our future investment deal flow and invest with as little as $5,000.

Member discussion